Are you tax ready?

As of June 2023, all UAE companies are legally required to file a corporate tax returnAre you tax ready?

As of June 2023, all UAE companies are legally

required to file a corporate tax return

Whether you’re within the tax threshold or not, your company MUST file a tax

return at the end of your fiscal year. Be tax ready with us, the leading UAE

corporate accounting firm.

Our

clients

50%

People don’t know Tax registration required

if you miss to comply

270

days

you can get penalty in

Do you have to

register for corporate

tax?

Do you have to register for corporate tax?

Any company with a license in the UAE is required to register. Even if you’re below the taxable income of 375,000 AED per year ( Except for natural persons conducting business with a turnover not exceeding AED 1 million )

From the End of the Fiscal Year, You Only Have

270 Days to Complete Your Return

From the End of the Fiscal Year, You Only Have 270 Days to Complete Your Return

That means you have less than 9-months to file a tax return under circumstances you and your accounting team have yet to experience. Penalty will be imposed as per cabinet decision.

So going at this without an expert’s help is likely to result in errors (both minor and large) that could lead to financial penalties and legal costs.

You may qualify for a small business tax relief

Is your turnover less than 3,000,000 AED?

To ease the financial burdens on small businesses,

the government is offering a tax relief system for the

first three years.

In short, if your turnover is less than 3,000,000 AED,

you may qualify for a tax relief up until the 31st of

December 2026.

To see if you qualify, book a free call with the button below.

To ease the financial burdens on small businesses, the government is offering a tax relief system for the first three years.

In short, if your turnover is less than 3,000,000 AED, you may qualify for a tax relief up until the 31st of December 2026.

To see if you qualify, book a free call with the button below.

The tax landscape is changing

Stay up-to-date with the leading UAE Corporate Tax

accounting firm

Stay up-to-date with the leading UAE Corporate Tax accounting firm

Many businesses are scrambling to figure out the new corporate tax guidelines.

Without an expert’s help, they’re likely to make many errors, leading to overpaying or receiving penalties in the near future.

Meet Dhanya, Your Tax Hero

Helping businesses lower taxes and save a fortune

Dhanya has 15+ years of experience helping companies of all sizes leverage their

deductibles, lower their yearly tax costs, and maximize their profits.

Since launching her business, she’s worked with over 300 companies, helping them optimize their finances and

experience peace of mind with her tailored strategies and tax plans.

Today, Dhanya continues to help companies from all industries. And since the launch of UAE’s Corporate

Tax, she’s excited to support her clients in a new world of finances.

Meet Dhanya, Your Tax Hero

Helping businesses lower taxes and save a fortune

Dhanya has 15+ years of experience helping companies of all sizes leverage their

deductibles, lower their yearly tax costs, and maximize their profits.

Since launching her business, she’s worked with over XX companies, helping them optimize their finances and

experience peace of mind with her tailored strategies and tax plans.

Today, Dhanya continues to help companies from all industries. And since the launch of UAE’s Corporate

Tax, she’s excited to support her clients in a new world of finances.

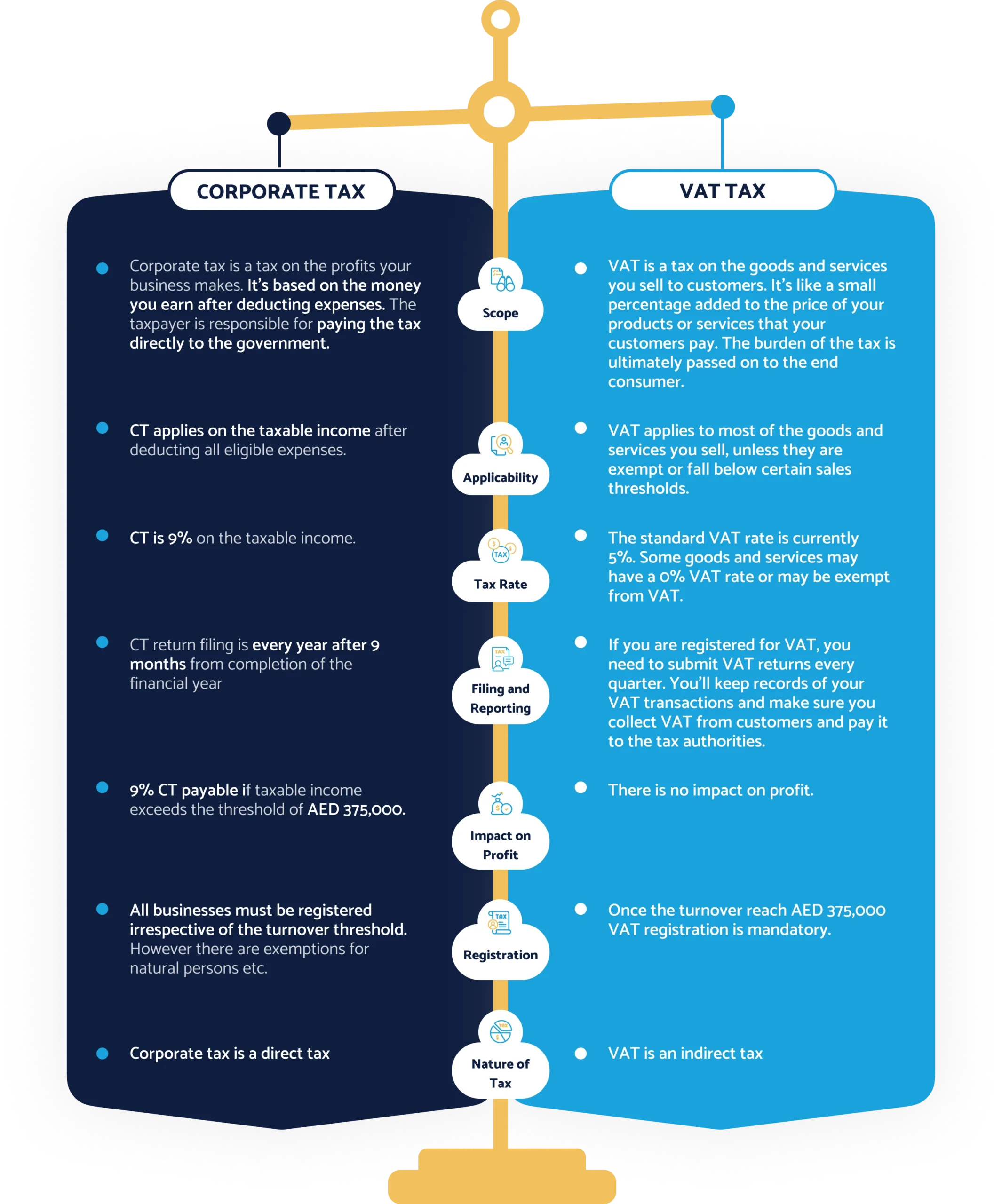

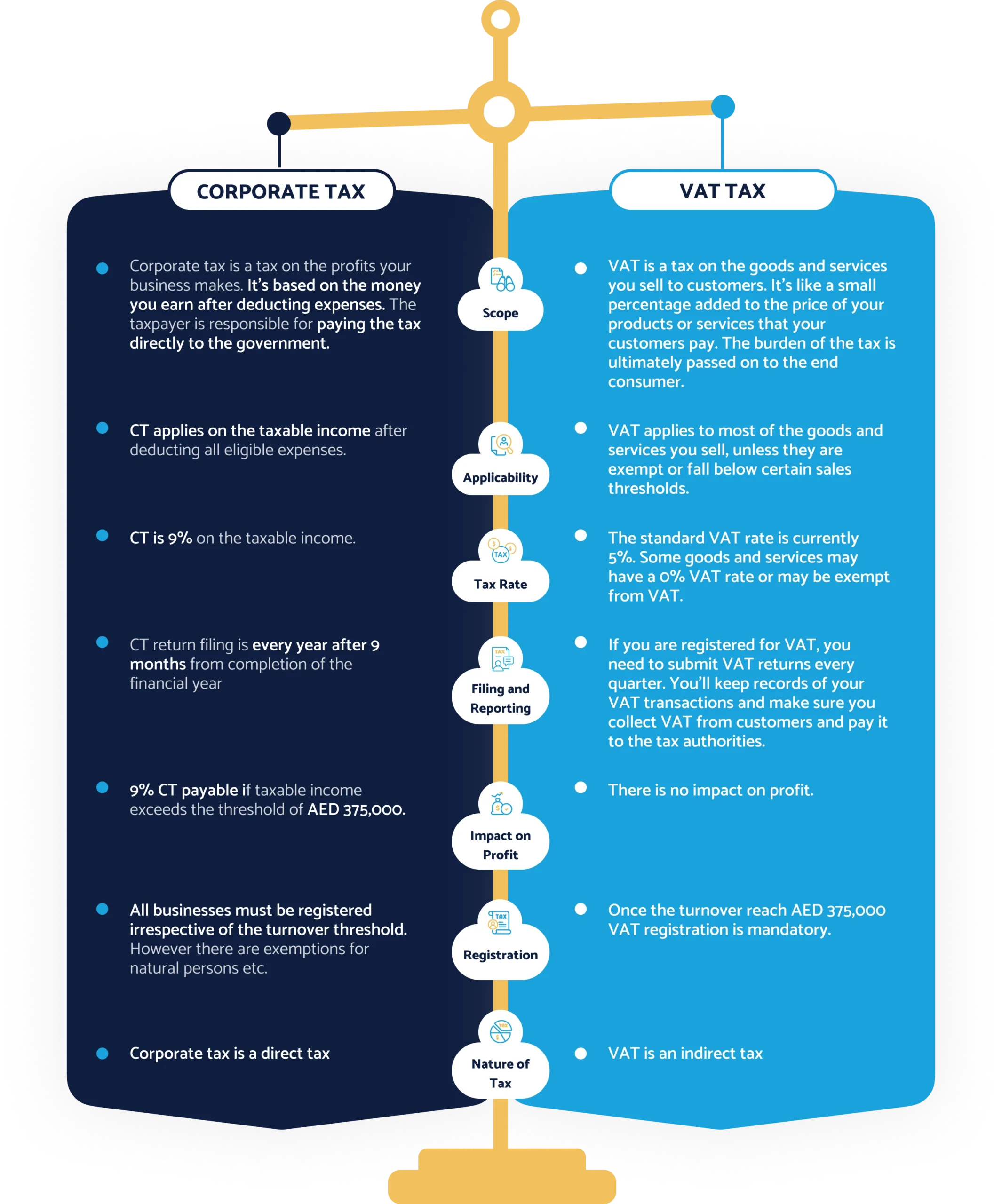

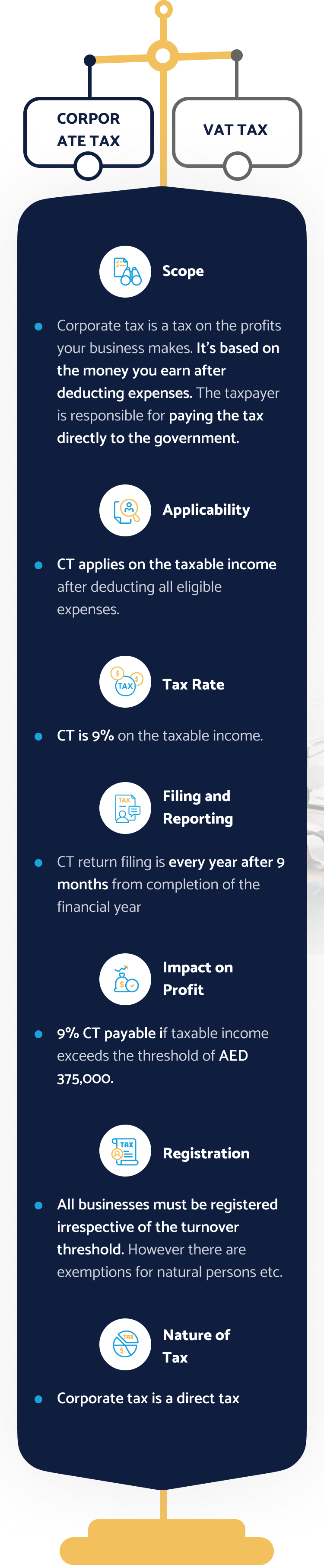

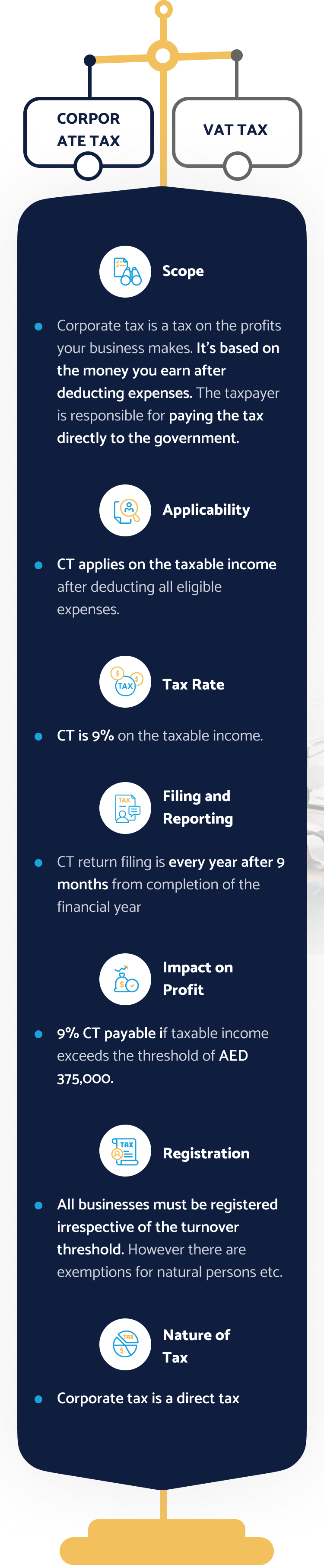

Tax Comparison

Many UAE companies are confused between VAT and Corporate Tax, leading them to make

costly mistakes. Below is a comparison to help you understand the differences between them.

Why RDS Accounting?

Experience Team

Receive support and guidance from a team of 30+ experts with 20+ years of experience

Pay Fewer Taxes & Avoid Mistakes

We know every pitfall that most businesses make. Working with us ensures you avoid them all and save a fortune on error penalties

Tailored Services

By working with companies of all sizes and industries, we can tailor our services to meet your specific requirements

Set Up Within Minutes

You can start and complete our set up process within minutes. Why not start by booking your free discovery call?

A Word from Our Clients

I’m a UC Davis graduate with a BA in Rhetoric and

Communications. As an enrolled agent, I an hold the same authority as an attorney and CPA in an IRS audit and can represent you are to an have throughout all levels of the IRS. I’m with a available year round

Sabrina Stamm

Founder, Vanwirk

I’m a UC Davis graduate with a BA in Rhetoric and

I’m a UC Davis graduate with a BA in Rhetoric and Communications. As an enrolled agent, I an hold the same authority as an attorney

Sabrina Stamm

Founder, Vanwirk

I’m a UC Davis graduate with a BA in Rhetoric and

I’m a UC Davis graduate with a BA in Rhetoric and Communications. As an enrolled agent, I an hold the same authority as an attorney

Sabrina Stamm

Founder, Vanwirk

I’m a UC Davis graduate with a BA in Rhetoric and

Communications. As an enrolled agent, I an hold the same authority as an attorney and CPA in an IRS audit and can represent you are to an have throughout all levels of the IRS. I’m with a available year round

Sabrina Stamm

Founder, Vanwirk

I’m a UC Davis graduate with a BA in Rhetoric and

I’m a UC Davis graduate with a BA in Rhetoric and Communications. As an enrolled agent, I an hold the same authority as an attorney

Sabrina Stamm

Founder, Vanwirk

I’m a UC Davis graduate with a BA in Rhetoric and

Communications. As an enrolled agent, I an hold the same authority as an attorney and CPA in an IRS audit and can represent you are to an have throughout all levels of the IRS. I’m with a available year round

Sabrina Stamm

Founder, Vanwirk

I’m a UC Davis graduate with a BA in Rhetoric and

I’m a UC Davis graduate with a BA in Rhetoric and Communications. As an enrolled agent, I an hold the same authority as an attorney

Sabrina Stamm

Founder, Vanwirk

I’m a UC Davis graduate with a BA in Rhetoric and

I’m a UC Davis graduate with a BA in Rhetoric and Communications. As an enrolled agent, I an hold the same authority as an attorney and CPA in an.

Sabrina Stamm

Founder, Vanwirk

-

Sabrina Stamm

Founder, Vanwirk

-

Sabrina Stamm

Founder, Vanwirk

-

Sabrina Stamm

Founder, Vanwirk

-

Sabrina Stamm

Founder, Vanwirk

Sabrina Stamm

Founder, Vanwirk

I’m a UC Davis graduate with a BA in Rhetoric and Communications. As an enrolled agent, I an hold the same authority as an attorney and CPA in an IRS audit and can represent you are to an have throughout all levels of the IRS. I’m with a available year round I’m a UC Davis graduate with a BA in Rhetoric and Communications. As an enrolled agent, I an hold the same authority as an attorney and CPA in an IRS audit and can represent you are to an have throughout all levels of the IRS.

Sabrina Stamm

Founder, Vanwirk

I’m a UC Davis graduate with a BA in Rhetoric and Communications. As an enrolled agent, I an hold the same authority as an attorney and CPA in an IRS audit and can represent you are to an have throughout all levels of the IRS. I’m with a available year round I’m a UC Davis graduate with a BA in Rhetoric and Communications. As an enrolled agent, I an hold the same authority as an attorney and CPA in an IRS audit and can represent you are to an have throughout all levels of the IRS.

Sabrina Stamm

Founder, Vanwirk

I’m a UC Davis graduate with a BA in Rhetoric and Communications. As an enrolled agent, I an hold the same authority as an attorney and CPA in an IRS audit and can represent you are to an have throughout all levels of the IRS. I’m with a available year round I’m a UC Davis graduate with a BA in Rhetoric and Communications. As an enrolled agent, I an hold the same authority as an attorney and CPA in an IRS audit and can represent you are to an have throughout all levels of the IRS.

Sabrina Stamm

Founder, Vanwirk

I’m a UC Davis graduate with a BA in Rhetoric and Communications. As an enrolled agent, I an hold the same authority as an attorney and CPA in an IRS audit and can represent you are to an have throughout all levels of the IRS. I’m with a available year round I’m a UC Davis graduate with a BA in Rhetoric and Communications. As an enrolled agent, I an hold the same authority as an attorney and CPA in an IRS audit and can represent you are to an have throughout all levels of the IRS.